This golf club has been hit with a 98% increase in its business rates

A Yorkshire golf club has seen its rateable value increase by £178,000 – even though it was only valued at £182,000.

The KP Club, which was bought by Darwin Escapes earlier this year, now has to pay the government more than £130,000 per year in rates, when previously it paid less than £90,000.

The club was recently developed to provide a boutique holiday lodge park as well as its 18-hole championship golf course over rolling parkland terrain.

The annual increase of more than £40,000 – nearly 50 per cent – makes it comfortably the hardest hit golf club in England and Wales by the business rates change, which came into effect this April, according to rates specialist CVS.

The firm found that of the more than 2,000 golf clubs in England and Wales, 551 experienced a tax rise, with them experiencing a 6.4 per cent hike on average, following the first business rates revaluation in seven years.

CVS states that golf clubs have seen vastly different changes to their rates with, for example, Open host Royal Birkdale experiencing a tax cut.

“Royal Birkdale’s rateable value remains unchanged at £162,000 after seven years but with a fall in the tax rate from 49.7p to 47.9p, it will see a cut in business rates of £1,063 this year for 2017/18, representing a 1.3 per cent cut in its bill,” said spokeswoman Claire Havey.

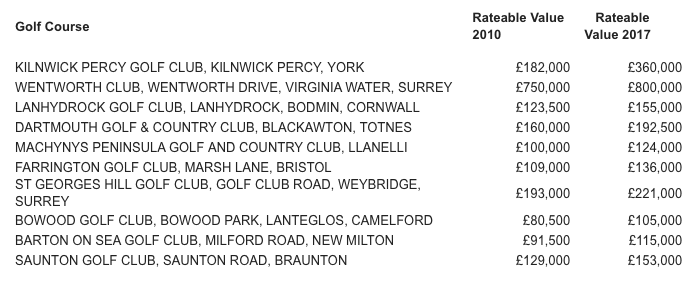

The top 10 biggest increases

“The news strengthens calls for reform of the business rates system at a time when golf club memberships – a club’s main source of income, followed by food and beverage sales – continue to fall, resulting in huge loss of earnings for less prestigious courses.”

Mark Rigby, chief executive of CVS said: “Golf course assessments are particularly tricky beasts when it comes to rates. Various factors affect the value of the course itself, and it’s disheartening to think that so many smaller, local courses could be at risk of closure because of their rates liabilities.

“The way the game is played has changed, but unfortunately, the way golf courses are rated looks to stay the same.”

Every golf club should check and appeal their rateable value themselves as a matter of course. Those west country clubs did us all a great favour by winning the case to get their rates reduced as a result of the golf industry’s general downturn.

The court decision benefits all golf clubs but it is important every club checks that their valuation office has considered(and probably reduced) their clubs RV as a result of that court ruling. If clubs don’t bother to appeal(its dead easy and Valuation Offices are very helpful) they do the whole industry a disservice. It sends the message that golf clubs have plenty of money and are not concerned by an increase.

And who do you thing called for all these additional courses?

The costs for operating an 18 hole facility continue to rise, as demonstrated by this business rates article, while income falls.

The U.K. Golf infrastructure is not fit for purpose, i.e we have an oversupply of 18 hole facilities and an under supply of compact starter facilities. Struggling golf courses should consider downsizing by selling land for housing and using some of the profit to convert to fun golf starter facilities.