How to use the pandemic to ensure your golf club’s bar and restaurant can grow

Food and beverage consultant Steven Brown explores what golf clubs can do to ensure their bars and restaurants can be as profitable as possible after the Covid-19 lockdown period ends.

This is a tragic time for the nations of the world. It is a traumatic time for the world of business and the golfing industry is no exception to that.

Golf clubs were just recovering from the crash in 2009 with member numbers stabilising and even showing growth and, added to which, Scotland survived the zero tolerance regarding alcohol consumption levels thus further affecting sales.

The pandemic has presented everyone with a unique challenge and one that none of us could have foreseen. Similarly, none of us knows with any certainty, when this will all end and some sense of normality finally returns.

So where does this leave golf clubs and their ability to survive the greatest challenge of our times?

Many clubs will have furloughed or laid off staff, especially the part timers in my area of specialism, food and beverage. The independent franchisees will be experiencing great hardships as will those clubs whose F&B services are in-house.

There is no doubt that a massive amount of re-building will have to be done in order to regain the ground lost to this awful disease, but perhaps your F&B staff can use these quiet times to take stock of their business and prepare for the eventual re-launch.

One of the most common concerns I receive when speaking to F&B employees is that, whilst they recognise that their skill levels can always be enhanced, they simply don’t have the time to put into place all of the improvements we identify because of the pressures of the normal working day. This can, of course, be frustrating.

With the closure of the club, and therefore no income generation, the first thought may be to let staff, even full timers go, in the hope of reducing the wage bill, and whilst newly introduced government schemes are softening the blow, one can perhaps understand this approach – my question is – does it have to be like this or does this furlough period offer golf clubs a golden opportunity to put their F&B operations in order?

Rather than dispense with staff services, why not fully utilise them in using their experience and skill to conduct a root and branch review of every aspect of your F&B business in a period when they won’t be disturbed or diverted.

If your club accepts this premise, then what key areas should your key staff be looking at. Here are a few examples of areas that will benefit the club in the long term.

- Dish costing exercises

- Understanding external stock results

- Customer surveys.

Please do not imagine for one moment that these highlighted issues are the only ones that need to be addressed. What I have highlighted are merely those issues that can be relatively easily completed and ones that will reap immediate returns.

Let’s look at each of the issues in turn

- Dish costing.

My experience of visiting golf clubs throughout the UK and investigating their F&B practices, is that over 90 per cent of them have never conducted or completed a full dish costing exercise on every dish available on the menu!

Why you might ask is this of any great importance? The answer is simple.

The average gross margin for the vast majority of golf clubs for their food operation is a miserly 54 per cent. This figure should and can be, easily in excess of 60 per cent after member discounts.

Now, the factors that affect that profitability are as follows.

- How much was paid for the product?

- How much cash profit is required for each dish?

- How much waste is involved (if any)?

We are not looking at a net profit here which would include all salaries, utility costs, marketing costs and so on.

In order to calculate your gross profit (£’s) and gross margins (%), you need to know what the cost is of putting every constituent on the plate of each dish, and then of how to calculate the retail price (VAT inclusive) to give you the correct margin in line with industry norms and of course of a worthy contribution to the clubs bottom line and not the miserly 54 per cent being achieved on average nationwide.

Now that your chef / cook has time on their hands, this process needs to be conducted before re-opening. If undertaken thoroughly then prices can be reset to reflect the correct margin, allowing for the right level of gross profit to be earned to help defray the costs of producing the food.

The process for chef / cook is simple – weigh out or count every item from the dishes recipe that goes into each dish and then cost out those items from the invoices supplied to them. Your dishes should be portion controlled (for example, six ounces of chips, two eggs, a ladle of beans, two slices of bread, pat of butter, salt and sauces). Once costed out then simply apply the formula for calculating the level of margin you wish to make (I would suggest a minimum 65 per cent pre members’ discount).

If you don’t know the formula, please don’t guess. Simply use the following free downloadable apps which will complete the task in seconds. The apps that serve me well are entitled the ‘Hospitality Calculator’ and ‘Lynx Purchasing’.

There is no need to guess at how much profit or loss you are making, simply undertake this exercise. It will take chef /cook a full day to complete it and then stay on top of it as wholesale prices change.

- External stock results.

I cannot understand for the life of me why golf clubs spend a lot of money on soliciting advice from professional external stock taking organisations and then fail to act upon the advice given or, worse still, do not fully understand what the results are telling them.

Every club in the country should, in my opinion, access external stock results for both the food and beverage units in order to protect the club from inefficient or even devious practice.

It is naïve to think that mistakes in controlling stock cannot be made leading to sometimes critical errors, or even that certain individuals will take advantage of ‘loopholes’ in club systems which allow them to abuse that system to their own advantage.

Independent stock results, from reputable and up to date providers, will go a long way in identifying both inefficient and dubious practices and ultimately protect your staff as well as the club.

Here are a few pointers regarding stock takes.

- You should always conduct stock takes on a monthly basis until trading figures are stabilised and then you may decrease the regularity to once every six weeks or even two months, only re-instituting the monthly regime when anomalies occur that cannot be explained.

- The staff responsible for generating the results must be given a copy of the report with the expectation that they will form an action plan to improve results. You should, in addition to these external results, conduct your own internal stock takes (perhaps on a weekly basis) as additional data to support or challenge the external report.

- Your F&B staff should be fully conversant with the results, understanding all of the factors that have influenced the results. This point, of all the above issues raised, is the single most important factor.

What is the point of generating a result if the stock taker identifies concerning issues and then the F&B managers or heads of departments, fail to act upon them because they didn’t understand what actions occurred to make the result positive or negative or worse still have no idea of the solutions needed to resolve those concerns?

There are a number of key areas to look at when receiving a result and I list but a few to use as KPIs:

Days’ stock

For a club that holds only a few events in the year, we would aim for an average days’ stock figure for a month of 20 to 25 days. For an event led unit this can, with the amounts of wine stored and consumed, rise to a figure of 50 days or even more. The problem is that I regularly encounter units with a 50 days’ stock figure that have no event activity at all. If that figure looks familiar on your latest stock results what is the problem?

- Firstly, over stocking leads to stock being written off due to due exceeding expiry dates

- Excessive stocks leads to poor rotation which in turn leads to more out of date scenarios.

- Excessive stocks can be used to disguise ‘unauthorised’ stock movements or unexplained losses other than ‘out of date scenarios’.

If you have weekly deliveries why do you need to carry 50 days’ stocks? Look at your own figures and ask yourself why, in the breakdown of individual lines, you have excessive amounts of stock.

- Resolutions

- Return stocks to wholesalers for credit

- Offer reduced prices on over-stocked products to remove them from stock (a 50 per cent gross margin is better that nothing at all!)

Your manager should be reviewing the days’ stock data on every individual product and taking the appropriate action as and when needed.

Gross margins

We know you cannot bank a percentage but they are an indication of whether or not you are performing in line with industry norms for golf clubs.

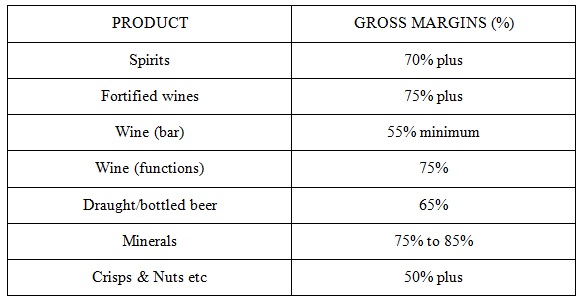

Here then is a guide to these industry norms by category:

Now remember – the eventual margin you receive will be impacted by

- The amount paid for the product

- The retail price set

- The amount of members’ discount.

Make sure you control all the above and your gross margins should hit your target every time.

Allowances

Always an area of contention and, it must be said, possible abuse.

Waste will happen in every unit on both food and beverage operation (oh and by the way, do not let your cook or chef tell you they don’t experience waste – they do! Do they record it or not? For a full listing of kitchen waste speak to your stock taker.)

In the bar operation you will inevitably fall foul of losses on pipe cleaning, drip tray waste, mis-pours, out of date stock, staff drinks, faulty equipment or failure, poor quality product, transfers to the kitchen and so on. (There ae 16 different ways in which product can be lost!)

The manager’s job is to control these issues wherever possible, and again we have a guideline on some of these waste issues.

Pipe cleans: These are affected by five different criteria including length of line, bore of pipes and so on but should fall within the parameters of two to five per cent loss of your total draught. Some outlets have less than one per cent loss, but that is because they have installed automated pipe cleaning systems that allow for cleans every four to six weeks and therefore reduce the amounts lost leading, in some cases, to large saving.

There are no industry guideline losses for drip tray waste, mis-pours and so on, but you should discuss with your stock taker what your actual average results of losses were for the past three to six months and then set a realistic target using that data (This will be illustrated as a percentage loss against all products sold.)

Regarding staff drinks the answer is simple – don’t allow them! Buy separate product to be used exclusively by staff and not counted into the stocks.

Of course you are going to lose product, and so long as you list every item lost and reason for its loss, you will be able to reduce the number of times they occur or better still the reason for them.

Set yourself an overall gross margin percentage for both bar and food operations and I suggest the following:

Bar – 60 per cent after member discount

Food – 62 per cent after member discount.

The yield is the single most important indication of how well the unit has performed over the period in question.

It is a measure of how well the unit has managed, controlled and maximised the purchase and sale of product without losing it!

The yield is expressed as a percentage. Typically the vast majority of cubs will generate a 94 per cent yield – this in effect means that some six per cent (plus) of product has been lost. The question is would this have been due to inefficiency, theft or mixture of both?

Suffice to say that for an outlet that generates some 55 per cent of its sales through draught beers and lager and the benefit of heads on pints, we expect a yield in excess of 99 per cent!

Customer surveys

When was the last time you conducted a customer survey that focused specifically on your food and beverage operation?

How can any business, let alone an F&B business that supplies a service that some 80 per cent of its clients never actually use on a regular basis, know and understand what it is that its members want from their food and beverage unit or, just as importantly, the reasons why those same members don’t support their own clubs food and beverage service?

The answer is that unless you provide your existing and potential customers with a platform to air their comments in an open and frank way, you cannot – all you are doing is working from old, historical data that focusses on what existing customers have done in the past, but that ignores the wishes and desires of the 80 per cent that do not patronise you, and for some very good reasons which you can only guess at!

Why not construct a customer questionnaire that will help you to decide the future direction of your business following your relaunch?

This is the perfect time to do this, as the intended recipients are probably at home and who would probably welcome the interruption to an otherwise slow day.

The topics you might include in your survey are:

- Range of products provided

- Pricing policies

- Quality of products

- Service standards

- Times of service

- Ambience of the dining areas

- Menu choices (alternative suggestions)

- On-course service

- Take away options

- Table service

- Product presentation

- Portion sizes

Do not forget to solicit their views on any other F&B issues they wish to raise, and consider offering an incentive to them to complete the forms. How about the individual survey drawn out a lucky dip that means that the winning individual pays no annual fees next year? Outrageous I hear you cry! Well it certainly worked for one of my clients who received an 86 per cent return from its membership, complete with a mountain of useful comments which helped us to shape their business model and with great success.

The truth is you don’t know what you don’t know!

By engaging with your market place at this time, you will be able to plan for any changes needed so that when you do open for business you have a new service to promote that reflects the customers’ wishes as they have expressed them.

Steven Brown FBII t.p. is the head of INN-FORMATION

Tel: 07785 276320

Email: herinn@aol.com

Let me tell You a sad story ! There are no comments yet, but You can be first one to comment this article.

Write a comment